The Compliance Layer: Why Carriers Care About Your Operations

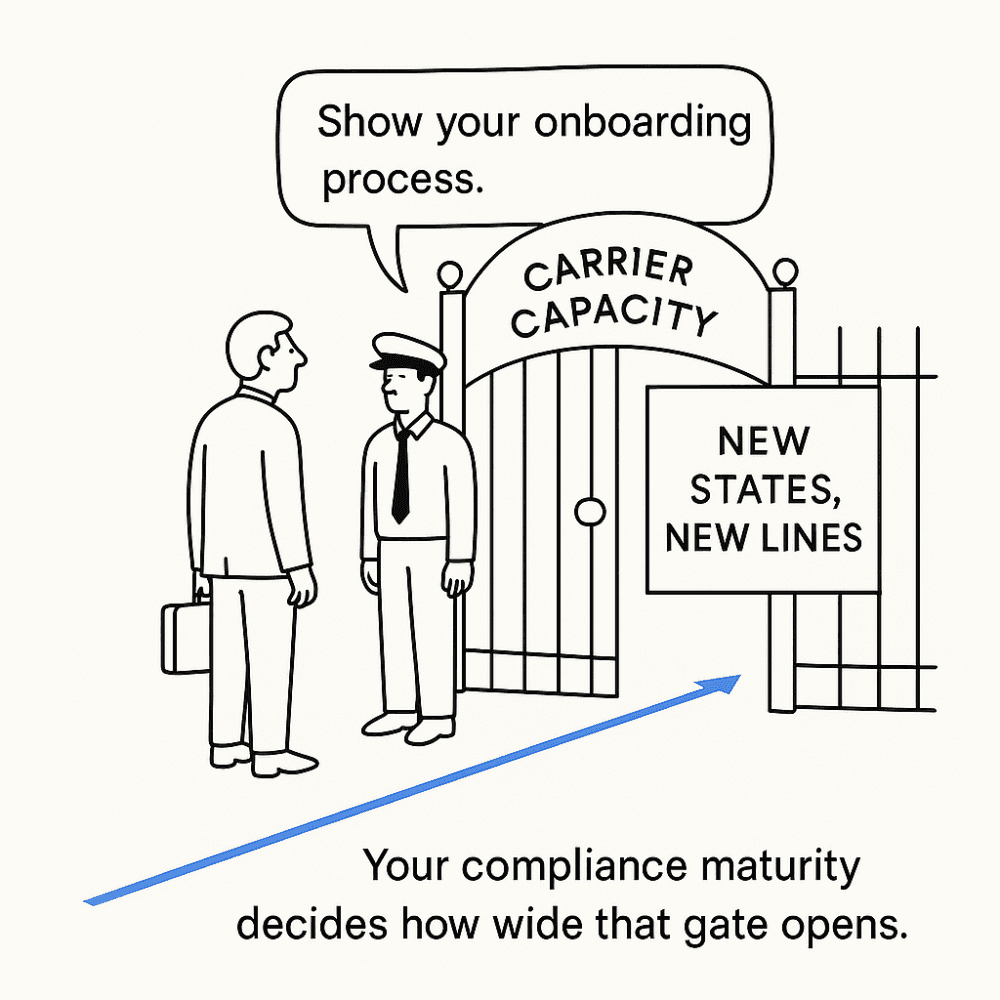

You're in a capacity negotiation with a regional carrier. Things are going well. Then the underwriter asks: "Walk me through your producer onboarding process."

You explain your steps. They nod along. Then: "How do you track appointment status? How often do you audit licenses? What happens when a producer's E&O lapses?"

Most MGAs think this is due diligence theater. It's not.

Why carriers actually care about this stuff

Look, carriers care about distribution and production volume. Of course they do. But they also care about operational risk, and here's the thing: when a producer writes business without a valid appointment, the carrier is on the hook. When licenses expire and nobody catches it, they have exposure. When E&O coverage lapses, they start worrying about claims defense costs.

So before they give you more capacity, they need to know you're not going to create compliance problems they have to clean up later. I've watched underwriters go from friendly to forensic in about thirty seconds when they realize an MGA doesn't have good answers to basic questions.

They're asking things like:

How fast do you catch expired licenses?

Can you produce appointment documentation on demand?

Do you have a system or are you running this in spreadsheets?

How many producers do you have and how many compliance staff?

This isn't about checking boxes. It's about whether your operations can actually handle the volume they're considering giving you. We're talking about paperwork and tracking, not rocket launches — but carriers want to see you're running things professionally.

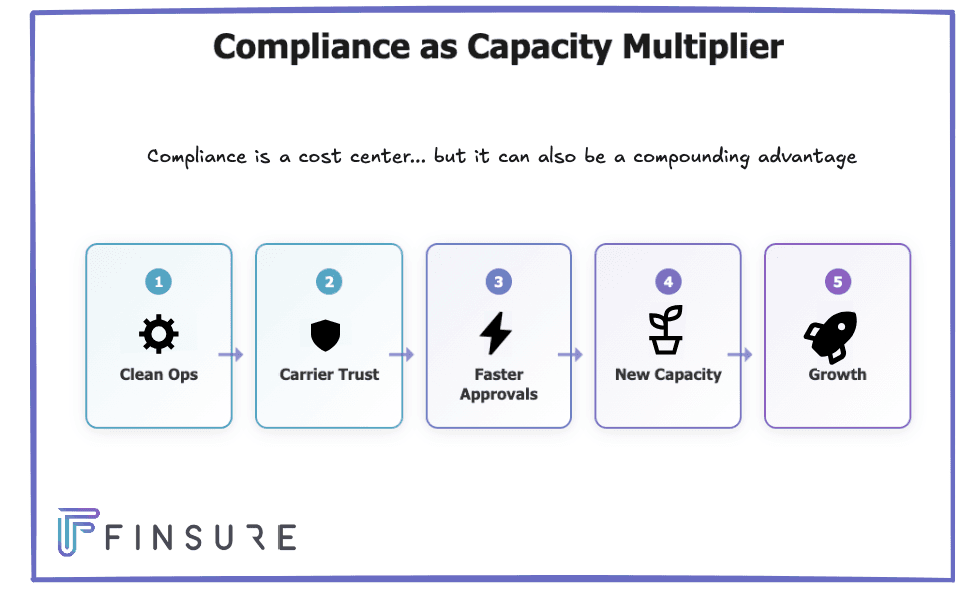

What clean compliance actually gets you

The MGAs with tight compliance operations get treated a little differently. Not dramatically, but noticeably.

Faster appointment processing. When carriers trust your intake process, your submissions don't get stuck in their compliance review queue. Better terms on commission splits and bonus structures because they're not worried you'll create regulatory headaches. More capacity when you want to expand into new states or lines. First call when they launch new products.

Does this matter? Yeah. Will it make or break you? Probably not. But clean compliance means fewer headaches, and it means carriers who actually pick up your calls when you need something.

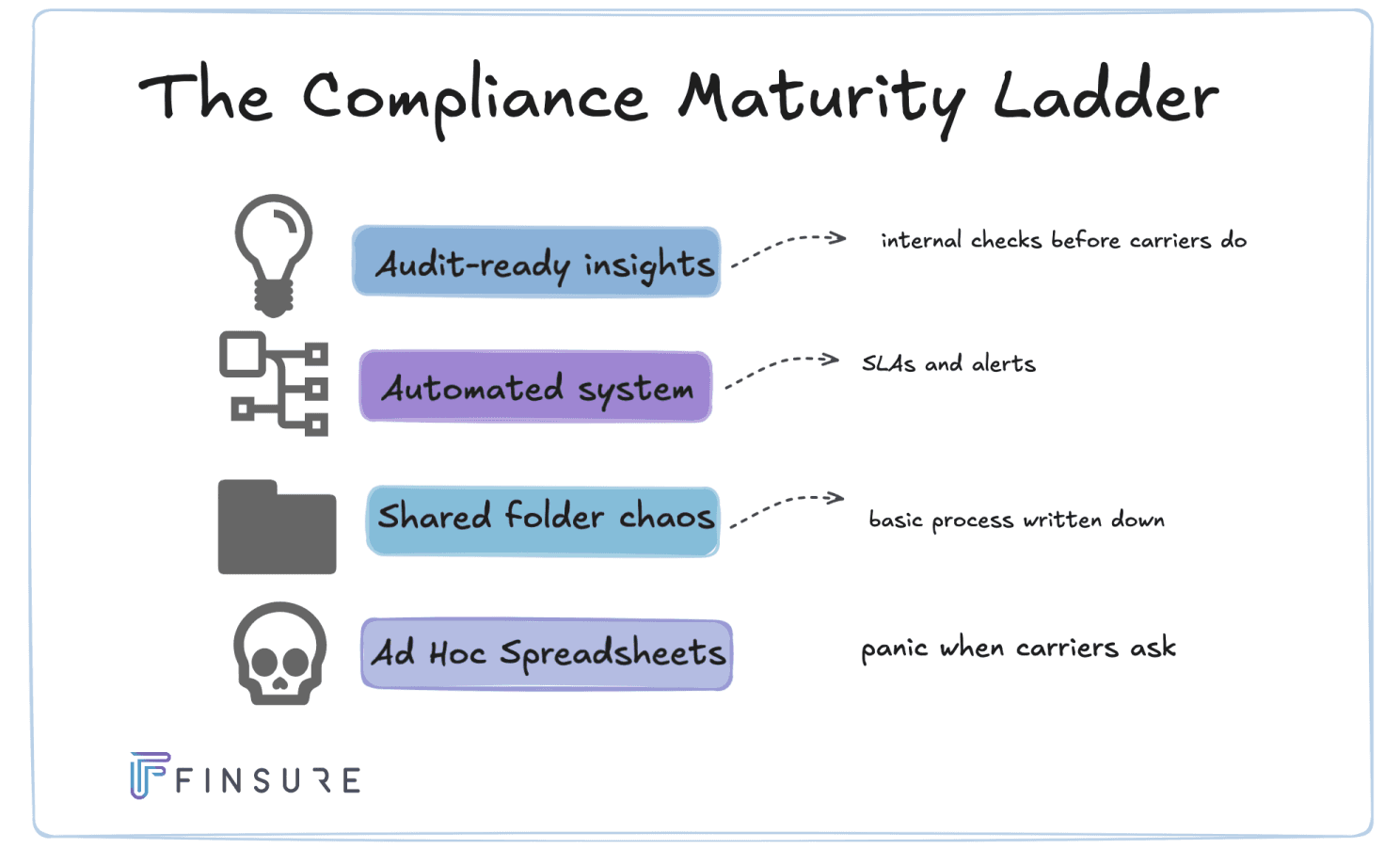

How to build the layer

You don't need perfection. You need visibility and consistency.

Document your process — write down how onboarding works, how you track appointments, how you monitor renewals, so when carriers ask you can hand them a one-pager instead of fumbling through a vague explanation. Track your SLAs: average time to complete onboarding, percentage of licenses renewed on time, appointment submission-to-approval time. Carriers respect data. Run internal audits once a quarter — pick ten random producers and verify everything is current so you find your gaps before carriers do.

And centralize everything. The faster you can answer "show me documentation for producer X," the more credible you are. Systems like ProducerFlow make this automatic, but honestly, even organized file structures work if you actually maintain them.

The goal isn't perfection. It's demonstrating you're running this professionally, at scale.

What we want to know

What's the toughest question a carrier has asked you about your compliance operations? The one that made you realize they were evaluating more than just your production?

Authors: Michelle Bothe & Ido Deutsch

About Producerflow

Producerflow is a modern platform designed to simplify producer management for insurance carriers, MGAs, and large agencies. By centralizing onboarding, compliance, licensing, and data integrations, Producerflow helps teams reduce operational friction, mitigate regulatory risk, and scale distribution with confidence.

Published

January 15, 2026