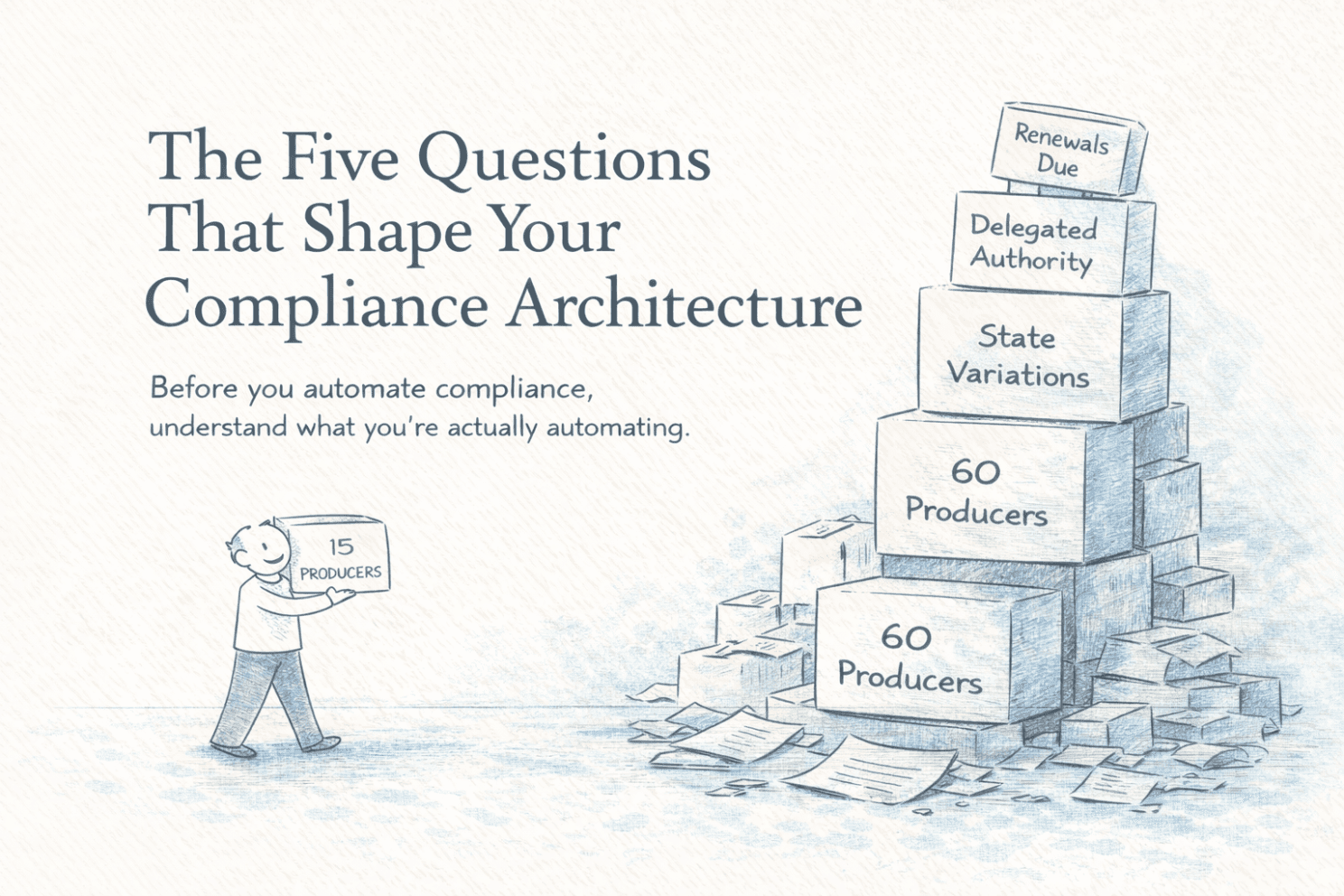

The Five Questions That Shape Your Compliance Architecture

Most MGAs shop for compliance tools the way they shop for a PAS: features, price, and whether the demo guy seems competent. But compliance architecture isn't really about the tool. It's about understanding your business model well enough to know what you actually need to monitor.

Before you write another check to anyone, it's worth answering five questions. Not because you'll die without them, but because they'll save you from buying something that doesn't fit—or worse, buying the right thing and configuring it wrong.

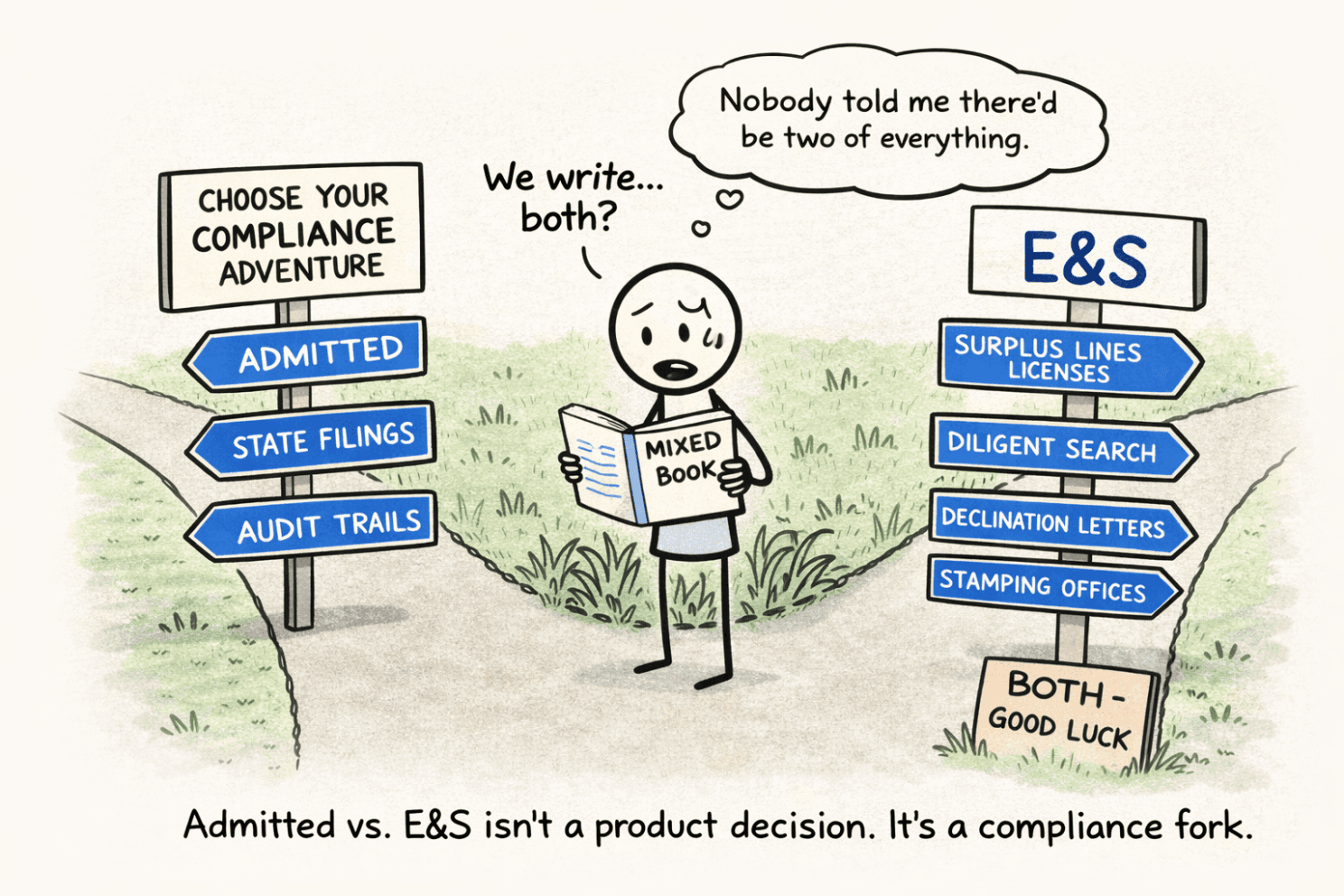

Question 1: What Are You Actually Writing?

This sounds obvious. But I've watched MGAs get 18 months into operations before realizing their compliance architecture was built for the wrong product mix.

Admitted vs. E&S isn't just a line of business distinction—it's a compliance fork in the road.

If you're writing admitted lines, your world revolves around carrier appointments, state filings, and audit trails that regulators love to scrutinize. Miss an appointment? In many states and carrier relationships, that’s treated as an unlicensed or unauthorized transaction—and therefore an E&O exposure waiting to happen.

If you're writing E&S, you're living in a different universe. Surplus lines licenses, diligent search documentation, affidavits, stamping office relationships. You're not just tracking licenses—you're proving due diligence, one declination letter at a time.

But here's the blind spot most mixed MGAs miss: Your producers might need both admitted appointments and surplus lines licenses. If you're only monitoring one, you've got a hidden exposure sitting in your book.

The takeaway: Your compliance tool can track licensing across both worlds, policy classification enforcement should happen upstream in your PAS or quoting engine before bind wherever possible. If you're waiting until the policy is bound to realize it's E&S and your producer isn't licensed for it, you're already too late.

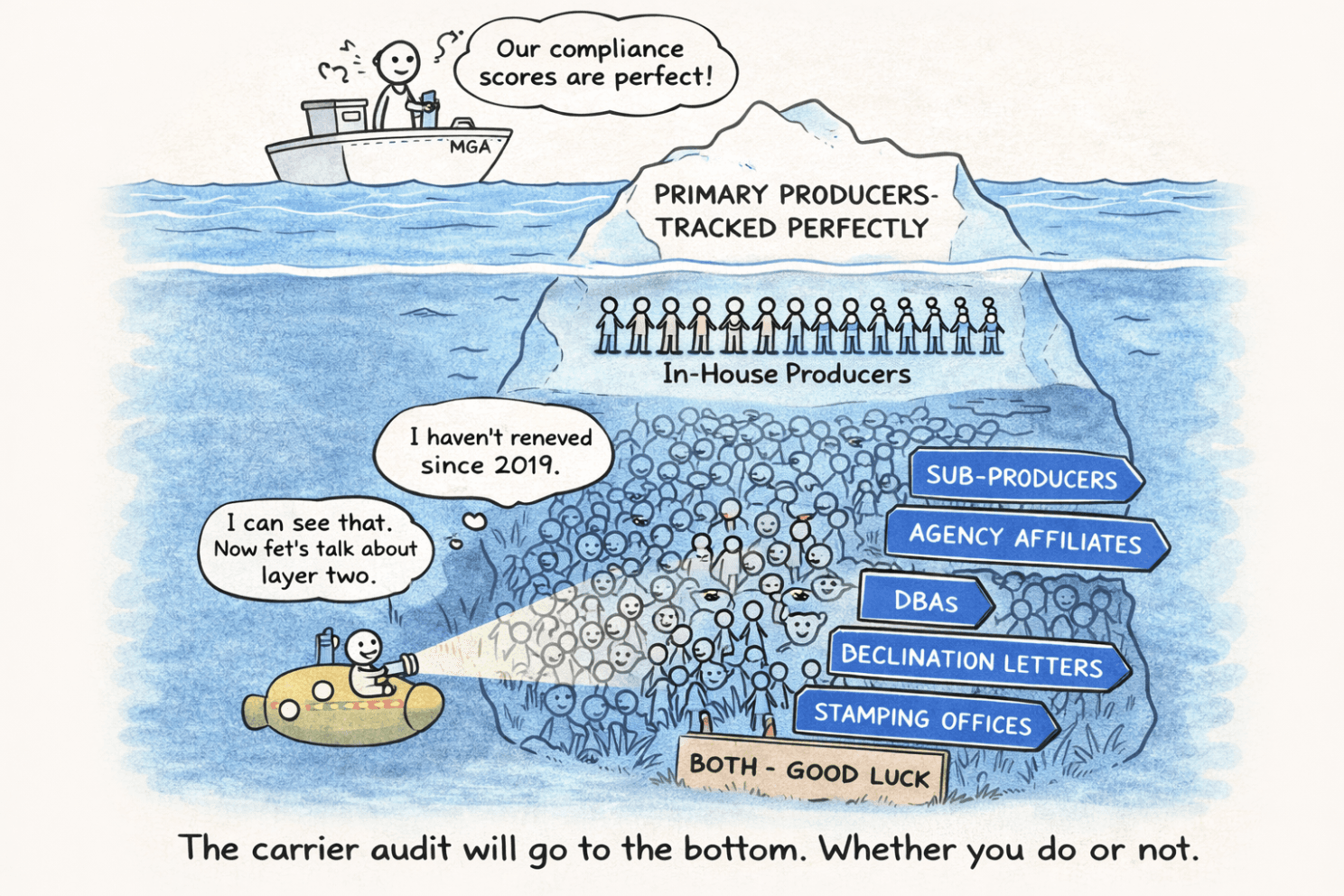

Question 2: How Do You Go to Market?

Your distribution model isn't a marketing choice—it's your compliance exposure profile.

In-house producers give you the cleanest data model. You hired them, you control them, you monitor them. Simple.

But retail and wholesale networks? That's where things get interesting. Now you're not just tracking individual producers—you're monitoring agencies, sub-producers, DBAs, and affiliations that change monthly. One retail agency partner might have 15 sub-producers across 8 states, and therefore you’re often contractually on the hook if any of them binds something they shouldn’t.

I know an MGA that spent a year meticulously tracking their 50 primary producers. Perfect compliance scores. But then a carrier audit dug one level deeper and found 200+ sub-producers they had no visibility into. Licenses expired, appointments missing, the whole nine yards.

Here's the reality: Most modern platforms can handle primary producers just fine. But few MGAs actually configure them to monitor the full hierarchy. It's not a software limitation; it's a design choice you have to make intentionally.

The question you need to answer: How many layers deep is your distribution chain, and how far down are you actually monitoring? Because the carrier audit will go to the bottom, whether you do or not.

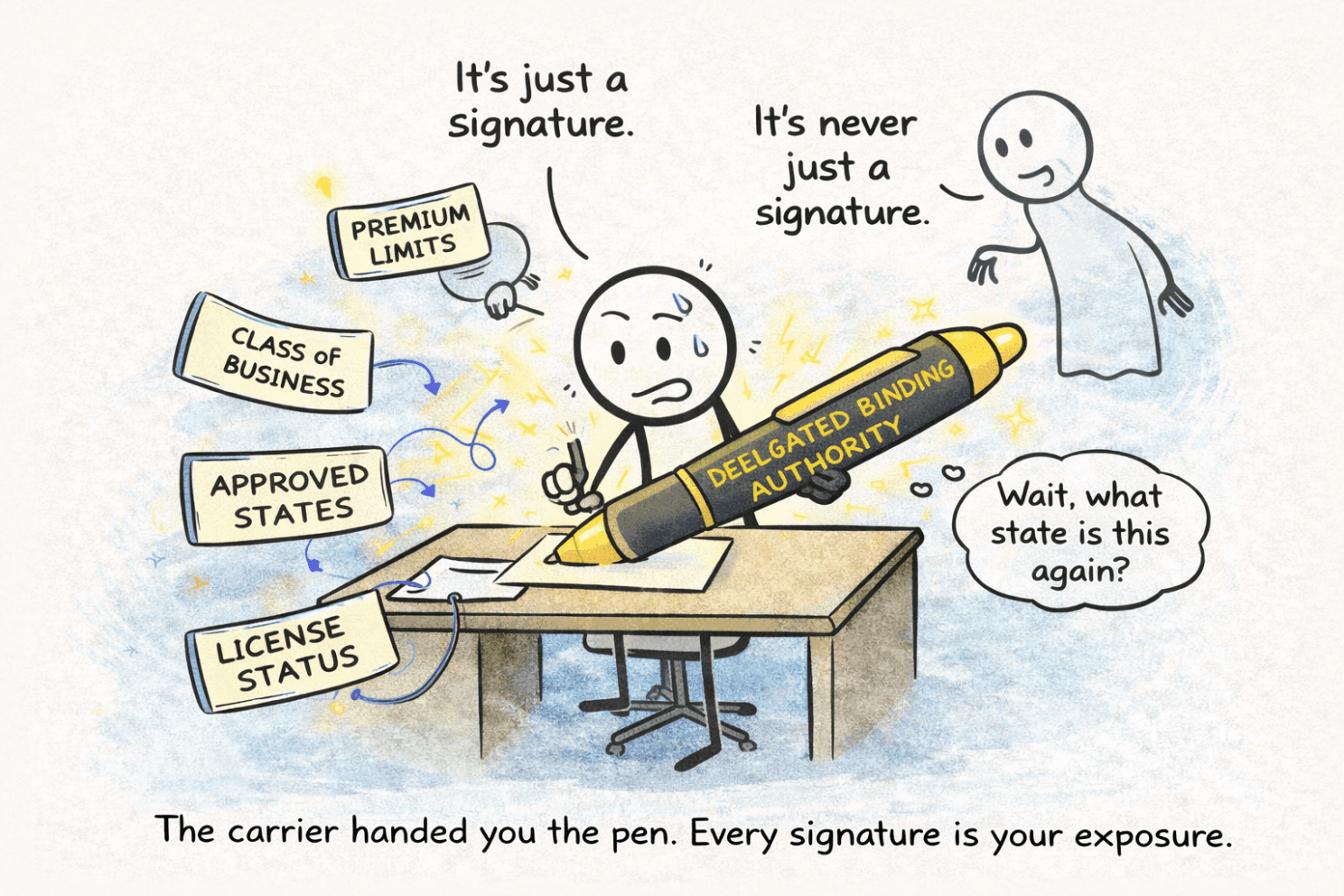

Question 3: Who Holds the Pen?

If you have delegated binding authority, you effectively own the compliance perimeter. The carrier has handed you the pen, and therefore every signature is your exposure.

I see MGAs obsess over license validity—which is important—but they completely forget to tie it to binding authority rules. You can have a perfectly licensed producer who's still out of compliance if they exceeded their premium authority, bound the wrong class of business, or wrote outside their approved states.

But here's the blind spot: Compliance isn't just a dashboard you check on Mondays. It has to be embedded in your underwriting system logic. If your PAS doesn't validate license + appointment + authority before issuing a quote, you're relying on people to remember the rules every time. That works until it doesn't.

Modern compliance tools can feed license data into your systems. But enforcement lives in your workflow. No software will fix a policy bound outside of authority—that's on you to design into your business logic.

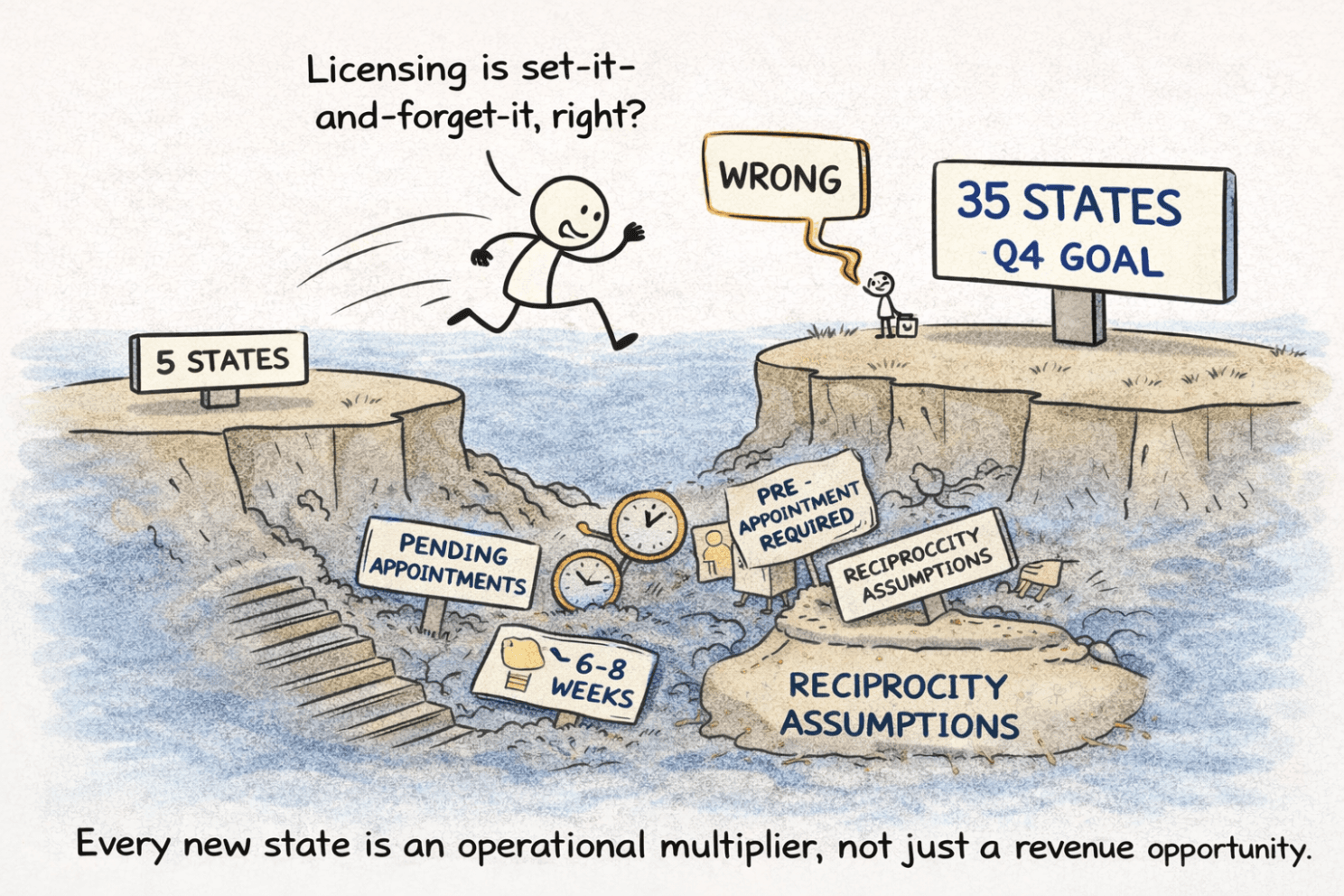

Question 4: How Wide Is Your Map?

Let me tell you about the MGA that tried to expand from 5 states to 35 in one quarter.

They assumed licensing was "set it and forget it." Apply for reciprocity, wait for approvals, scale revenue. But what they didn't account for was that Just-In-Time appointments aren't universal. Some carriers need pre-appointments in certain states. Some lines require additional certifications.

Therefore, by month three, they had 60+ pending appointments stuck in state bureaucracy, producers writing business they assumed they were licensed for, and a backlog that took 18 months to clean up.

Every new state is an operational multiplier, not just a revenue opportunity.

You need two documents: a real-time footprint map (where every producer is licensed, appointed, and active today) and a licensing intent plan (where you're expanding and what the compliance lead time is for each state).

Good compliance tools excel at the first part—the real-time view. But the second part? That's strategic planning, not software. You need to know that California takes weeks for certain carrier appointments while Texas might be same-day. Factor compliance timelines into your growth model, or you'll scale into chaos.

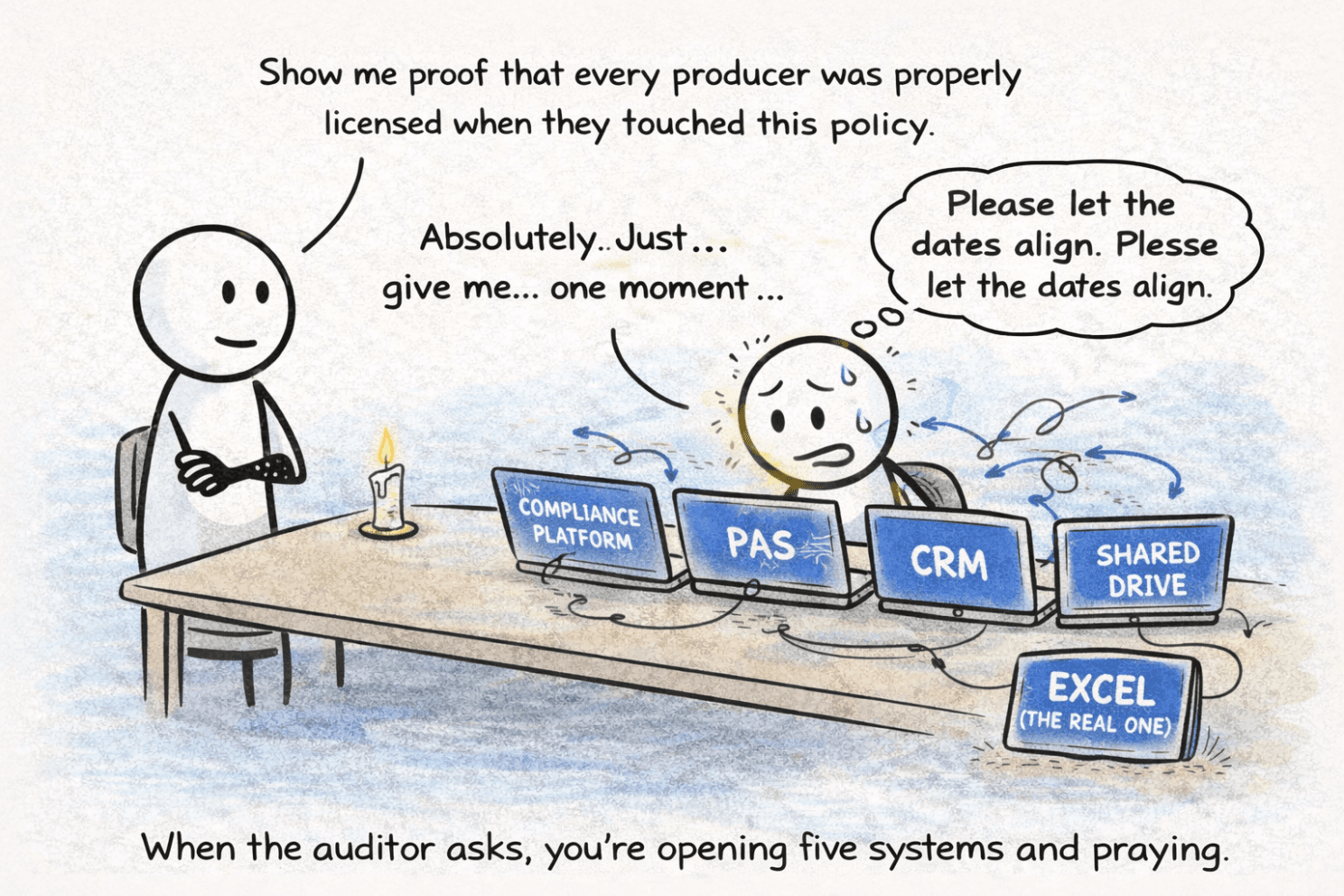

Question 5: What's Your System of Record?

This is where most MGAs fall apart in an audit.

You've got licenses in your compliance platform, policies in your PAS, producer relationships in your CRM, and E&O certificates in a shared drive. But when the auditor asks, "Show me proof that every producer who touched this policy was properly licensed and appointed," you're opening five systems and praying the dates align.

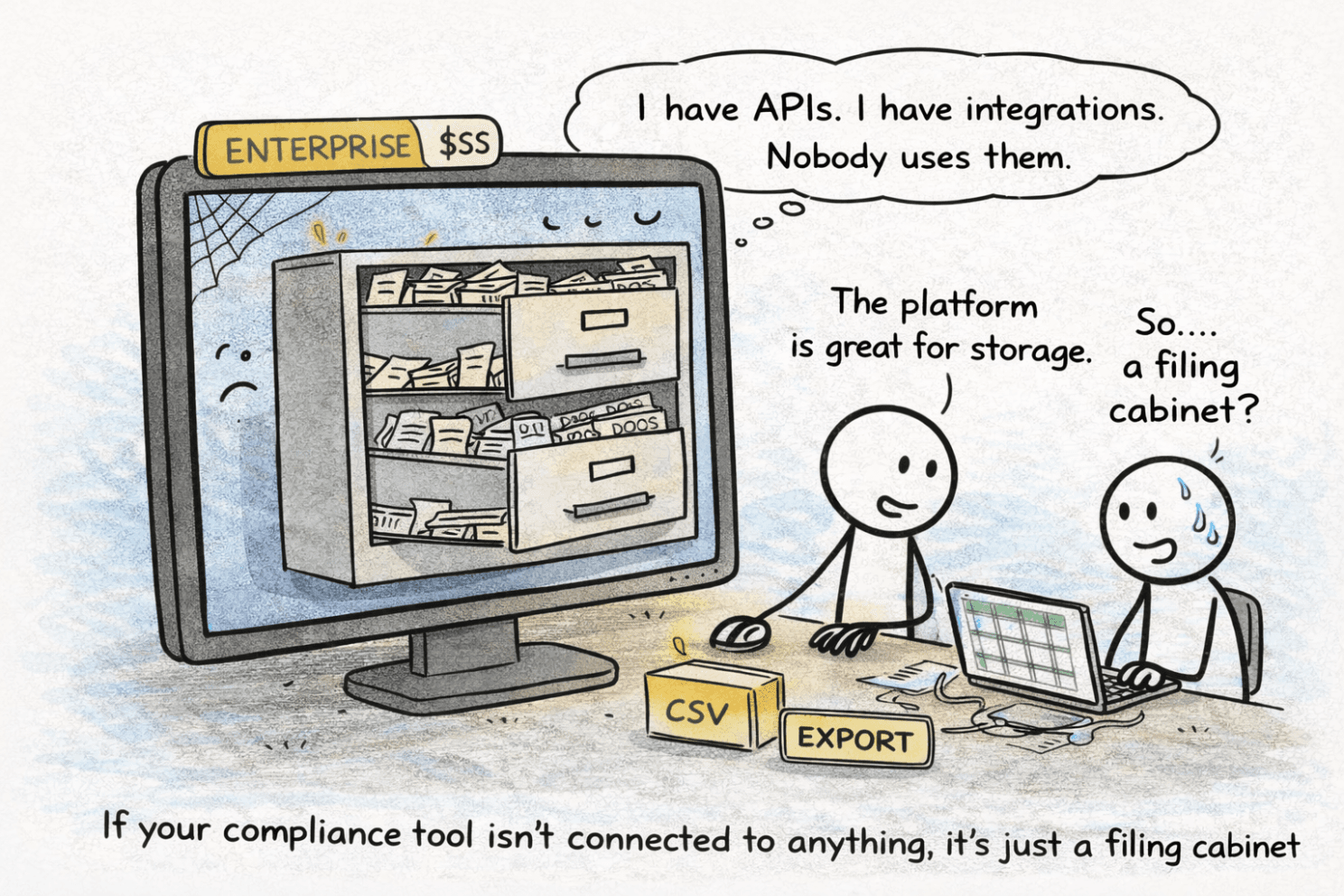

A compliance tool shouldn’t be a filing cabinet. In many MGAs, it becomes the system of record for licensing, appointments, and attestation but only if it’s designed that way.

But here's the catch: it can only be that if you design it that way. What data lives where? How does it sync? Who owns updates?

I've watched MGAs treat compliance platforms like storage lockers—filled with documents but not connected to anything. Therefore, when the carrier asks for a report, they're exporting CSVs and manually cross-referencing them in Excel.

Here's the design principle I wish someone had told me earlier: Your PAS owns policy data. Your CRM owns producer relationships. Your compliance tool owns proof and attestation. But none of them matter if they don't talk to each other.

You need frequent, automated syncs between systems—often nightly—for true audit readiness. If you're manually updating producer statuses across three platforms, you've already lost. And if your vendor charges enterprise prices but can't integrate cleanly with modern systems? That's not a compliance tool—it's a filing cabinet with a login screen.

Design Before You Deploy

Compliance architecture isn't about avoiding fines—though that's a nice bonus. It's about earning trust.

Carriers don't just want clean data. They want proof you know where it lives. They want to see that when a producer gets terminated, you didn't just update a status field—you disabled their access, canceled their appointments, archived their book, and documented every step.

Before you evaluate compliance software, sketch your architecture using these five questions:

What products are we writing? (Admitted, E&S, or both—and how do we classify them?)

How do we distribute? (In-house, retail, wholesale—and how many layers deep?)

What authority do we hold? (Delegated binding, submission-only—and where's the control point?)

Where do we operate? (Current footprint + 12-month expansion plan + lead times)

Where does truth live? (System of record for each data type + integration map)

If you can answer these five questions clearly, you're already ahead of 80% of new MGAs—no matter which logo you choose.

Because at the end of the day, compliance tools don't make you compliant. They just make good architecture run faster. And you don't need to pay enterprise prices to get there.

Authors: Michelle Bothe & Ido Deutsch

About Producerflow

Producerflow is a modern platform designed to simplify producer management for insurance carriers, MGAs, and large agencies. By centralizing onboarding, compliance, licensing, and data integrations, Producerflow helps teams reduce operational friction, mitigate regulatory risk, and scale distribution with confidence.

Published

January 16, 2026